Fascination About Sanders introduces tax on billionaire wealth gains to provide

Why thousands of millionaires don't pay federal income taxes - The Washington Post

6 Simple Techniques For Bezos, Musk and other billionaires pay next to nothing in income

Icahn acknowledged that he is a "big debtor. I do borrow a great deal of money." Asked if he secures loans likewise to lower his tax costs, Icahn stated: "No, not at all. My borrowing is to win." He said changed gross earnings was a misleading figure for him. After taking numerous millions in deductions for the interest on his loans, he signed up tax losses for both years, he said.

From Jeff Bezos to Elon Musk, several billionaires paid no income tax for THESE period - International Business News - Zee News

"There's a factor it's called income tax," he stated. "The reason is if, if you're a poor person, an abundant person, if you are Apple if you have no income, you don't pay taxes." He added: "Do you believe an abundant individual should pay taxes no matter what? The Latest Info Found Here do not think it's germane.

Billionaires pay no taxes while workers get no raises - Yahoo - An Overview

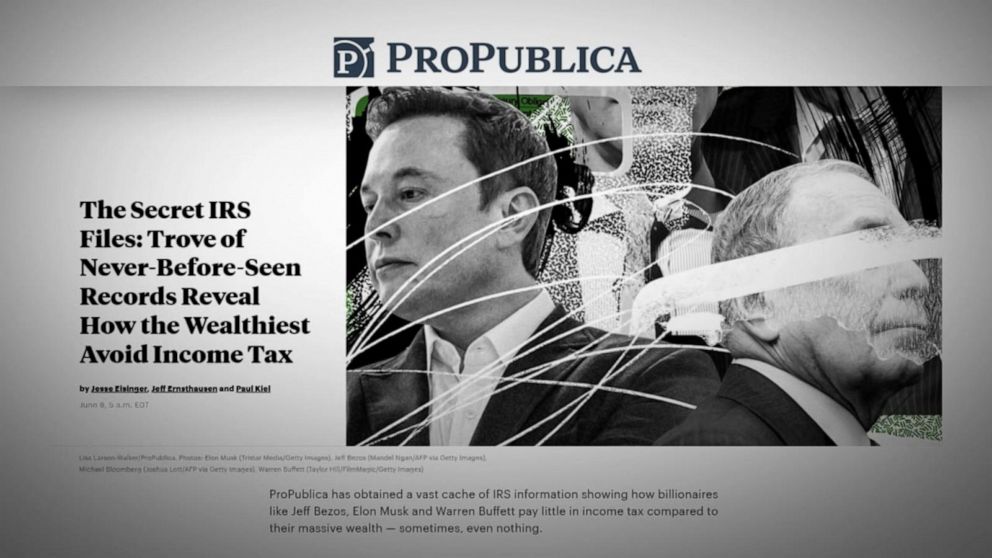

In 2018, nine of the 25 most affluent Americans reported more than $500 million in earnings and three more than $1 billion. In such cases, though, the information gotten by Pro, Publica shows billionaires have a palette of tax-avoidance options to offset their gains using credits, deductions (which can include charitable donations) or losses to lower and even absolutely no out their tax expenses.

In 2018, he reported income of $1. 9 billion. When it pertained to his taxes, Bloomberg handled to slash his expense by utilizing reductions enabled by tax cuts passed during the Trump administration, charitable contributions of $968. 3 million and credits for having paid foreign taxes. The end outcome was that he paid $70.

Never Sell Assets And Pay Less In Taxes Like Billionaires Things To Know Before You Get This

That amounts to just a 3. 7% standard earnings tax rate. Between 2014 and 2018, Bloomberg had a real tax rate of 1. 30%. In a declaration, a spokesman for Bloomberg noted that as a prospect, Bloomberg had actually promoted tax hikes on the rich. "Mike Bloomberg pays the optimal tax rate on all federal, state, local and global taxable earnings as recommended by law," the representative composed.

In the United States no civilian need to fear the illegal release of their taxes. We mean to utilize all legal means at our disposal to determine which individual or federal government entity leaked these and ensure that they are held accountable."Eventually, after decades of wealth accumulation, the estate tax is expected to work as a backstop, allowing authorities an opportunity to take a piece of huge fortunes before they pass to a new generation.